Insurers results for 9 months

Insurance exchange participants of PDMA have committed to disclosing their metrics every month, and the NAIU office is processing them promptly for the needs of the participants and all interested parties.

Strategic analysis and planning

Strategic analysis and planning. These are periodic meetings, strategic sessions of participants, which are held within the framework of NAIU and are dedicated to forecasting the state of the risk insurance market and vectors of its development

The NAIU continues the path to a solvent, stable, competitve insurance market in Ukraine with proper protection of the rights of consumers of insurance services

Present an overview of the new law of Ukraine “On Insurance”, the preparation and implementation of which is the task of this and the next years for the market and the NBU

Simplifying financial monitoring without losing vigilance

The NAIU continues the joint search with stakeholders for ways to simplify financial monitoring by insurers while maintaining the obligation to achieve its objectives.

The NAIU initiative for high-quality and affordable medical care for people with the involvement of insurers

NAIU welcomes the efforts of the Ministry of Health regarding health insurance and the recently adopted Roadmap for the implementation of health insurance, supports the arguments and steps defined in it

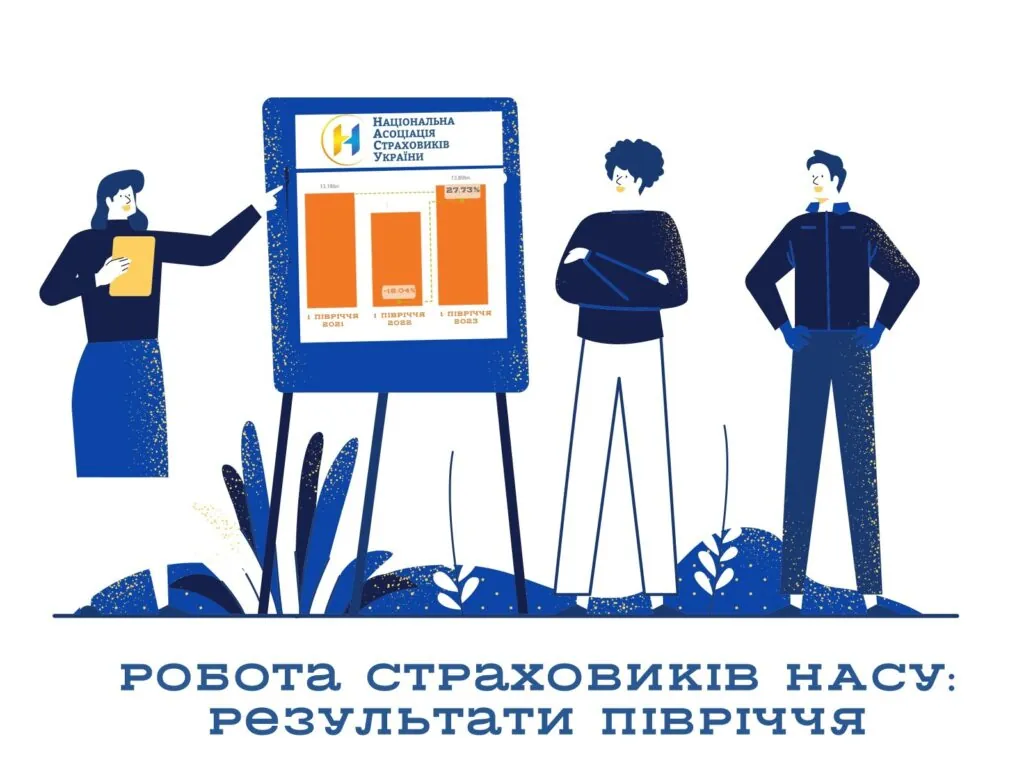

The results of the insurance market in the first half of 2023

The insurance market of Ukraine continues to actively recover in the first half of 2023

Performance indicators of NAIU insurers for the first half of 2023

Summer is the time for vacations, but also the time for the results of the first half of the year

NAIU summer general meeting

NAIU members gathered to discuss the current situation in the insurance market and the Association’s activities

NAIU workshop: implementation of Chapter 13 of the new Law of Ukraine “On insurance”

The NAIU office, together with the members of the Association, continues the path of research and development

Demand for war risk insurance: A joint dialogue

The association’s insurers have taken part in an exclusive workshop “Demand for War Risk Insurance: A Joint Dialogue”