War risk insurance

Injuries from warfare, damaged homes and health, wrecked cars, and ruined businesses. It hurts everyone. But we’re glad insurance can be a positive and helpful force amid this horror

Dialogue between partners: roundtable of leaders from the medical and insurance industries

Discussion of current issues regarding the development and improvement of medical insurance

We achieve our goals together

Discussions with the National Bank of Ukraine revolve around urgent and relevant issues arising during the alignment of insurers’ activities with the requirements of the new Insurance Law

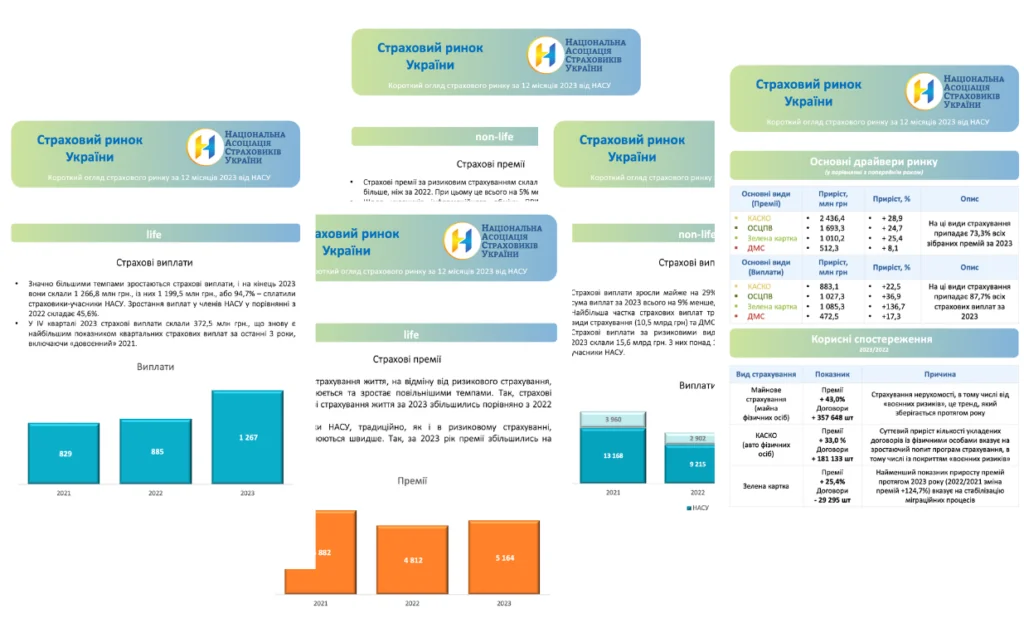

Brief overview of the insurance market for 2023 from NAIU

A Brief Overview of the Insurance Market for 2023: Simplifying the Complex.

Thanks to the MTSBU and NAIU, data from the motor vehicle became more accessible

We offer new indicators that can be interesting and useful to both consumers and insurers from among the already familiar data from the auto-civil system, which are now conveniently and up-to-date visualized by means of Power BI.

In NAUI, the results of 2023 were summed up

Many initiatives developed in NAUI 2023 were implemented

NAIU determined what and with what will be achieved in 2024

Next year will be the year of implementation of revolutionary legislative changes in the insurance market

Announcement of competitive selection for the position of general manager

NAIU fulfilling the requirements of the statutory documents, announces a competition for the position of the association’s leader.

Memorandum on partnership between NAIU & MTIBU was concluded

The Memorandum of Partnership was signed between the National Association of Insurers of Ukraine and the Motor (Transport) Insurance Bureau of Ukraine

Interview with Denis Yastreb for Banker.ua

The recovery of Ukraine in the post-war period is one of the most critical issues that everyone is already addressing today